By: Lawrence Harte

Companies are looking for ways to make more money by providing OTT and related services. Broadcasters are transitioning to streaming TV, OTT service providers are developing new services, and content owners are finding new OTT distribution opportunities. Unfortunately, OTT service profit margins are decreasing due to many new OTT competitors. Changes to TV systems and maintaining software apps can be expensive. New types of service can be complex, costly, and risky to launch. This article covers new and emerging ways to earn revenue from OTT systems while reducing costs and risks.

This article is a summary of the OTT Business Opportunities course and book. The course and book identifies additional opportunities, provides more details, includes added benchmarks, and contains lists of key companies involved in each opportunity area. You can find additional information about them at OTTBusiness.com/courses

Key OTT Business Opportunities

Key OTT Business opportunities in 2020 and forward include OTT services, Multi-platform Advertising, TV Apps, Social TV, and tCommerce. These stand out from the many other OTT opportunities because they are already high growth established multibillion dollar industries.

Global OTT Revenues for Movies and TV Episodes will reach $167B in 2025 [Digital TV Research]

Media distribution and production companies are looking for new ways to make more money by providing OTT and related services. Broadcasters are transitioning from shared channels to streaming TV, OTT service providers are developing new types of services, and content owners are finding new OTT distribution opportunities.

OTT Service Business

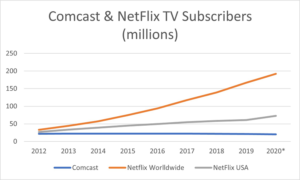

Over the top television (OTT) services are the providing of movies, TV shows, and other video content through the Internet. In 2019, there were over 266 OTT service providers in the United States [Parks Associates] with an industry revenue growth rate of over 20% [Amazon AWS].

OTT key service choices include content offerings, production & distribution platforms, and engagement optimization.

Figure 2 shows that OTT key service business opportunities include content, platform, and viewer engagement. OTT content options include original video productions, repackaged media, and licensed content. OTT platforms can be custom developed, open systems such as Android, or Streaming TV distribution services. Engagement involves measuring & changing user experiences to minimize churn, optimizing content offers to increase consumption, and personalizing experiences to develop brand value.

OTT business models can be non-traditional opportunities. For example, the webisodes production company AwesomenessTV.com started 2012 only producing short online TV shows. One of their most successful shows was Royal Crush. It is a web series drama produced for Royal Caribbean cruise line filmed on their cruise ships (awesome branding opportunity). Some of the 8 min shows got over 4M+ viewers per show.

Dreamworks acquired AwesomenessTV in 2014 for $33M. Hearst Media purchased 25% equity in AwesomenessTV 2015 for $81.25M.

OTT Advertising

OTT Advertising is insertion of media or messages into or around television content that is delivered through the Internet. This includes video ad insertions, graphic ad overlays, or interactive ad media. Key OTT Advertising opportunities include cross-platform advertising, dynamic ad insertion (DAI), and personalized advertising.

Figure 3 shows that OTT advertising opportunities include cross-channels advertising, targeted dynamic ad insertion (DAI), and personalized ads. OTT advertising systems can create campaigns that insert ads and repackaged promotional messages to multiple media channels such as Youtube, Facebook, and others. OTT ads can be dynamically selected and inserted based on on and off network viewer activities & interests. OTT ad content can be modified with offers, elements and linked to response channels such as Smart TV and device forms to allow immediate and measurable responses.

Targeted OTT advertising has multiple times revenue opportunity as compared to traditional broadcast advertising. According to Adstage research, the average cost per click on the Google PPC system in 2018 was $2.76. Because only a small number of people who see the ad click on it (about 4%), Adstage determined that the cost per impression was a little over $116 per thousand. $116 cpm is more than 10x higher than the traditional local television advertising rates of $5 to $20 cpm. The reason for this difference is the ability to target ads to highly qualified audiences. OTT systems can offer better viewer targeting, offers, and content personalization than the Google PPC systems [https://blog.adstage.io/google-adwords-benchmarks-q1-2018].

TV Apps

TV apps are software programs that run inside TV viewing devices such as Smart TVs that can be connected to the Internet. Key ways to use TV apps to make revenue include using apps to provide streaming services, in app advertising, and in app services or purchases.

Figure 4 shows how OTT providers can use TV App players, in app ads, and in-app purchases to develop new revenue sources. TV app players enable streaming, on demand, and interactive services. In app promotional messages can be pushed to viewers when context criterias have been met. TV app users can do in app purchases of content along with products and services.

According to AppAnnie.com mobile research, the global App marketplace will pass $122B in 2019 [ https://techcrunch.com/2018/12/05/app-stores-to-pass-122b-in-2019-with-gaming-and-subscriptions-driving-growth/]. Getting TV apps installed into Smart TVs and media adapters can be challenging. A little known fact is that in the early launch of NetFlix and Amazon Video, launches, these companies paid up to $50 for each new subscriber signup. Some service providers even paid monthly service commissions (residuals) on customer service purchases.

Social TV

Social TV is the merging of television broadcast and audience engagement services to provide a viewing experience where people can find, see, and/or interact with shared media. Social TV can range from displaying summarized social media information (live poll results) to live sports video clipping and publishing to attract audiences. The initial business opportunity concept for social TV was second screen – viewing show related content on a 2nd device such as a Smartphone. Because the rollout of second screen services had disappointing results, Social TV companies may avoid the term Social TV and prefer to use Audience Engagement services. Key social TV opportunities include supplemental media, user generated content (UGC), and fan management systems.

Figure 5 shows that OTT providers can use social TV content and services to engage, manage, and monetize fans. Social content can include supplemental media (e.g. behind the scenes & back stories), user generated content (UGC), and blended media (shows combined with social content). Social TV services include social program guides (SPG), social ratings services, and second screen (synchronized and/or companion content). Fan management includes finding and working with key influencers, working with and/or running fan events, and other valuable fan activities.

According to Transparency Research, the Social TV Market (broadcast integration, audience engagement, content moderation, and other services) in 2018 in the USA was $437M with an estimated average 13% growth rate until 2026.

Television Commerce (tCommerce)

Television commerce (tCommerce) is the providing of electronic commerce (eCommerce) services through television systems. Research and testing have shown that tCommerce revenue can be 10x more than revenues earned from broadcast and streaming. Key opportunities in the tCommerce industry include affiliate advertiser programs, direct product sales, and OTT interactive shopping channels.

Figure 6 shows that television commerce (tCommerce) options include affiliate, direct response, and interactive shopping channels. Affiliate programs earn commissions when they refer viewers to partners when they purchase products. OTT systems can provide enhanced direct response television – DRTV infomercial like services allow viewers to directly buy products while they are watching ads or related content. OTT shopping channels allow for viewing and interacting with product videos on a shopping channel.

The eCommerce worldwide marketplace was 3.9 trillion US dollars in 2020 and it is projected to grow to 6 trillion by 2024 [source: eMarketer & Koncept Analytics]. While most of the eCommerce revenue is processed on smartphones & P.Cs, it is relatively easy to enable eCommerce transactions to smart TVs because they are Internet connected viewing devices.